I’m bearish on Tesla (NASDAQ:TSLA), and I can’t assist however assume that Elon Musk’s announcement relating to the unveiling of a Robotaxi on August 8 is one thing of a distraction. So, why would Musk be distracting us? Properly, automobile gross sales are slowing, margins are falling, and Tesla’s dominance within the electrical automobile (EV) phase is over. Plus, the inventory’s valuation is excessive. This is the reason I’m bearish on TSLA inventory, however I don’t anticipate it to maneuver a lot till we all know what Musk has in retailer for us on August 8.

Tesla’s Efficiency Is Underwhelming

In Q1, Tesla reported a 9% decline in quarterly income — the steepest year-over-year decline since 2012 — and a 48% lower in adjusted revenue. The corporate’s adjusted earnings per share (EPS) got here in at 45 cents versus the anticipated 49 cents. Additionally, income for the quarter fell to $21.3 billion — lower than the $22.2 billion the market had anticipated.

Income fell each on a year-over-year foundation and sequentially. In the meantime, web earnings dropped 55% to $1.13 billion from $2.51 billion a yr in the past. On a non-adjusted foundation, web earnings per share fell from 73 cents a yr in the past to 34 cents in Q1 2024. Furthermore, in an more and more aggressive market, Tesla’s value cuts negatively impacted margins with no apparent finish in sight.

Nevertheless, Musk additionally pointed to unexpected challenges as a purpose for the corporate’s underperformance. “We navigated a number of unexpected challenges in addition to the ramp of the up to date Mannequin 3 in Fremont. As all of us have seen, the EV adoption price globally is underneath strain, and loads of different order producers are pulling again on EVs and pursuing plug-in hybrids as an alternative. We consider this isn’t the suitable technique, and electrical autos will finally dominate the market,” Musk mentioned within the Q1 earnings name.

Am I Underestimating Tesla’s AI Potential?

In Q1, Tesla’s free money movement turned detrimental. The Austin-based firm reported a deficit of $2.53 billion, representing a big change from a yr in the past when Tesla had a free money movement of $441 million. Within the fourth quarter of 2023, Tesla reported free money movement of $2.06 billion. Tesla defined that the detrimental money movement was as a result of a $2.7 billion improve in stock and $1 billion in capital expenditures on synthetic intelligence (AI) infrastructure.

AI is actually the buzzword of investing at this second in time, and I don’t consider that it’s overused. Nevertheless, some analysts are arguing that buyers shouldn’t be valuing Tesla as a automobile firm however as a tech firm on the forefront of AI.

I’m somewhat skeptical about this, regardless that I respect that Tesla has AI capabilities in areas like manufacturing, the Tesla Bot, and power buying and selling. To date, although, I’m but to be satisfied that these are components of the enterprise with revenue-generating capability that’s remotely comparable with automobile manufacturing.

After all, the AI-enabled Robotaxi may change my opinion. The query is whether or not Tesla has actually managed to realize a quantum leap in autonomous expertise. This would really put Tesla within the driving seat and set up its dominance within the autonomous phase.

The expansion of the Robotaxi phase would additionally open up one other revenue-generating phase, which does look extremely engaging. Autonomous automobiles require a number of computational energy, however that energy would solely be used when the automobile is lively. This implies these spectacular computer systems will solely be used a fraction of the time.

Just like Amazon (NASDAQ:AMZN) Internet Providers, Tesla may promote this spare capability and create a brand new and probably sizeable income stream. “It looks like form of a no brainer to say, OK, if we’ve obtained thousands and thousands after which tens of thousands and thousands of autos on the market the place the computer systems are idle more often than not that we would properly have them do one thing helpful,” Musk mentioned within the Q1 outcomes name, including that Tesla may have 100 gigawatts of “helpful compute.”

Tesla’s Valuation and Musk’s Guarantees

Musk has a behavior of overpromising and underdelivering. So, for this reason I stay bearish on Tesla. I’ve but to see proof that Tesla is about to drop a totally autonomous automobile, which occurs to have spare computational capability that can be utilized and offered as a part of some Tesla cloud.

This wouldn’t be an issue if Tesla’s valuation was in step with its friends. Nevertheless, Tesla is presently buying and selling round 70x ahead earnings. What’s extra, analysts clearly aren’t satisfied that progress will choose up within the medium time period, with a price-to-earnings-to-growth ratio of 5.75x.

For now, the promise of an autonomous automobile seems to be holding the share value elevated regardless of the dearth of concrete info. All eyes, due to this fact, are on August 8. I consider the inventory may tread water till then.

Is Tesla Inventory a Purchase, In keeping with Analysts?

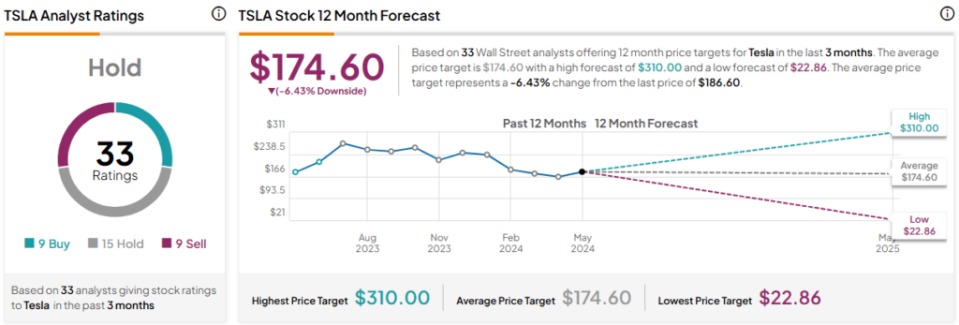

On TipRanks, Tesla is available in as a Maintain primarily based on 9 Buys, 15 Holds, and 9 Promote scores assigned by analysts previously three months. The common Tesla inventory value goal is $174.60, implying 6.4% draw back potential.

The Backside Line on Tesla Inventory

Personally, I’m skeptical as as to if Tesla has actually made a breakthrough in autonomous autos. Nonetheless, I settle for that Robotaxi and totally autonomous autos, on the whole, have enormous potential. This potential isn’t restricted to the street but additionally, as Musk mentioned, the flexibility to promote unused computing energy to the remainder of the market. Nevertheless, at 70x ahead earnings, I merely can’t put my cash behind Tesla.