The shares of main fintech firms Block (NYSE: SQ) and Paypal (NASDAQ: PYPL) have been on rollercoaster rides the previous few years. Nonetheless, each shares are set as much as have sturdy years in 2024 and ought to be strong performers within the years to return.

Block

Block is finest recognized for its Sq. ecosystem, which was first designed to permit sellers to simply accept credit score and debit card funds from their telephones or tablets, however has since advanced into a complete product suite for retailers. The corporate additionally owns Money App, which is understood for its free peer-to-peer cost community however which has additionally expanded into different providers.

The corporate has shifted its focus in recent times from income progress to worthwhile progress. Block is seeking to obtain the Rule of 40 metric by 2026. This metric is when an organization’s income progress price and revenue margin are 40% or above, and demonstrates that an organization is rising responsibly. For its Rule of 40 calculation, Block is utilizing adjusted working margin. Its adjusted working earnings excludes curiosity earnings, taxes, one-time prices, and a few non-cash amortization objects.

Block is seeking to broaden its Sq. vendor enterprise by simplifying its pricing and enhancing its buyer onboarding expertise, together with having extra formal multi-year contracts for bigger sellers. It has additionally been concentrating on particular industries with merchandise particularly designed for these verticals, corresponding to Sq. for Franchises. It is also added synthetic intelligence (AI) options to assist sellers automate operations and velocity up workflows.

On the Money App aspect, the corporate is seeking to transfer upmarket to turn into the first financial institution for households incomes as much as $150,000. A part of its technique will likely be to cater to households, and to benefit from the social nature of the app. Block additionally plans to supply extra providers corresponding to free overdraft protection, yield on financial savings balances, and automated paycheck distributions to draw prospects. It plans to combine extra commerce instruments into its platform, such because the purchase now, pay later Afterpay characteristic and service provider discovery.

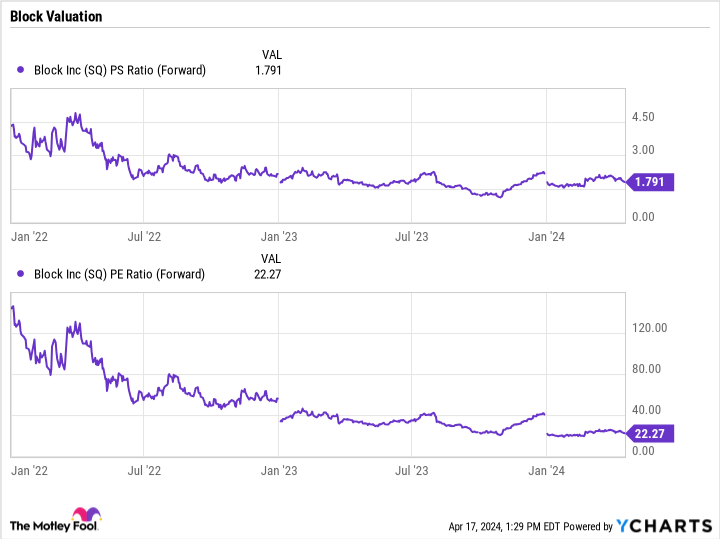

Buying and selling at about 22 instances ahead earnings and fewer than 2 instances gross sales, Block seems to be attractively priced for a fast-growing firm that’s turning into more and more worthwhile.

PayPal

PayPal is finest recognized for its namesake cost platform, however the firm additionally owns the favored Venmo app and Braintree.

Braintree, which is an unbranded cost backend utilized by e-commerce retailers, has been the large income progress driver for the corporate in recent times. Nonetheless, the service was priced aggressively to get established with prospects and take share. With product improvements, PayPal administration now feels that it has the perfect providing within the market and that it could actually value extra to worth. It’s now extra targeted on worthwhile progress and believes it’s going to see improved margins as effectively.

The corporate can be set to make use of AI to assist enhance and drive progress. It launched plenty of new modern AI-enabled options earlier this 12 months, together with options revolving round enhancing buyer engagement and personalization.

One of many firm’s greatest new choices is Fastlane. Fastlane saves customers’ data and lets them try with one faucet, with no need a username or password or having to share a bank card with completely different retailers. This makes the buying and checkout course of a lot simpler for patrons, whereas it results in extra gross sales for retailers utilizing the product.

Early outcomes for Fastlane have been sturdy, and the providing may very well be a giant progress driver for PayPal. It additionally reveals the kind of innovation the corporate can develop with the assistance of AI, which might result in future progress as effectively.

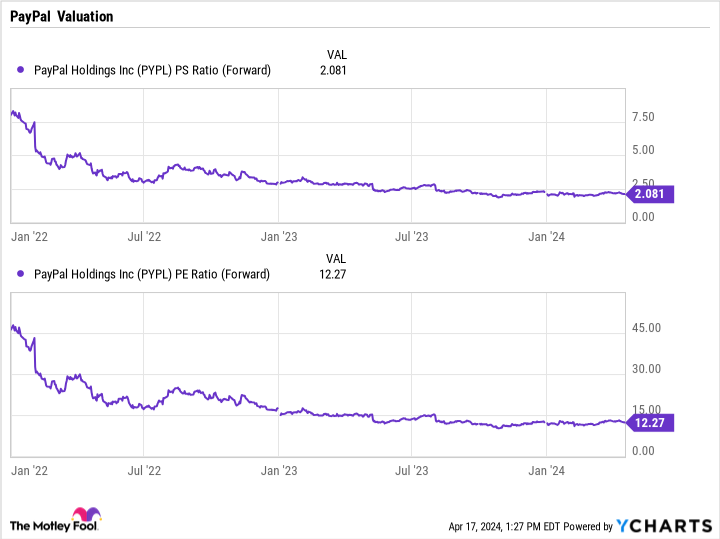

Buying and selling at 2 instances gross sales and a ahead price-to-earnings ratio of about 12, PayPal’s inventory is cheap for a corporation that appears poised to reaccelerate progress.

Two strong shares for the long run

Each Block and PayPal are attractively priced fintech shares that look poised to have sturdy performances this 12 months and past. Each are starting to focus extra on worthwhile progress and utilizing AI know-how to enhance their choices. AI is a giant theme out there, however the impact of AI within the fintech sector appears to be presently flying below the radar, making it a sexy time to purchase Block and PayPal at present ranges for the long run.

Do you have to make investments $1,000 in Block proper now?

Before you purchase inventory in Block, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Block wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $518,784!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 15, 2024

Geoffrey Seiler has positions in Block and PayPal. The Motley Idiot has positions in and recommends Block and PayPal. The Motley Idiot recommends the next choices: brief June 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure coverage.

These 2 Fintech Shares Are Set to Soar in 2024 and Past was initially printed by The Motley Idiot