Why it issues: Many imagine that cup substrate expertise will allow the business to maintain Moore’s Regulation past 2030, making certain steady improvement with out being constrained by course of measurement limitations. Samsung goals to outpace Intel, which has been researching glass substrates for almost a decade and intends to include them into industrial merchandise by 2030. With its up to date timeline, the South Korean conglomerate stands a superb likelihood of launching its merchandise forward of Intel.

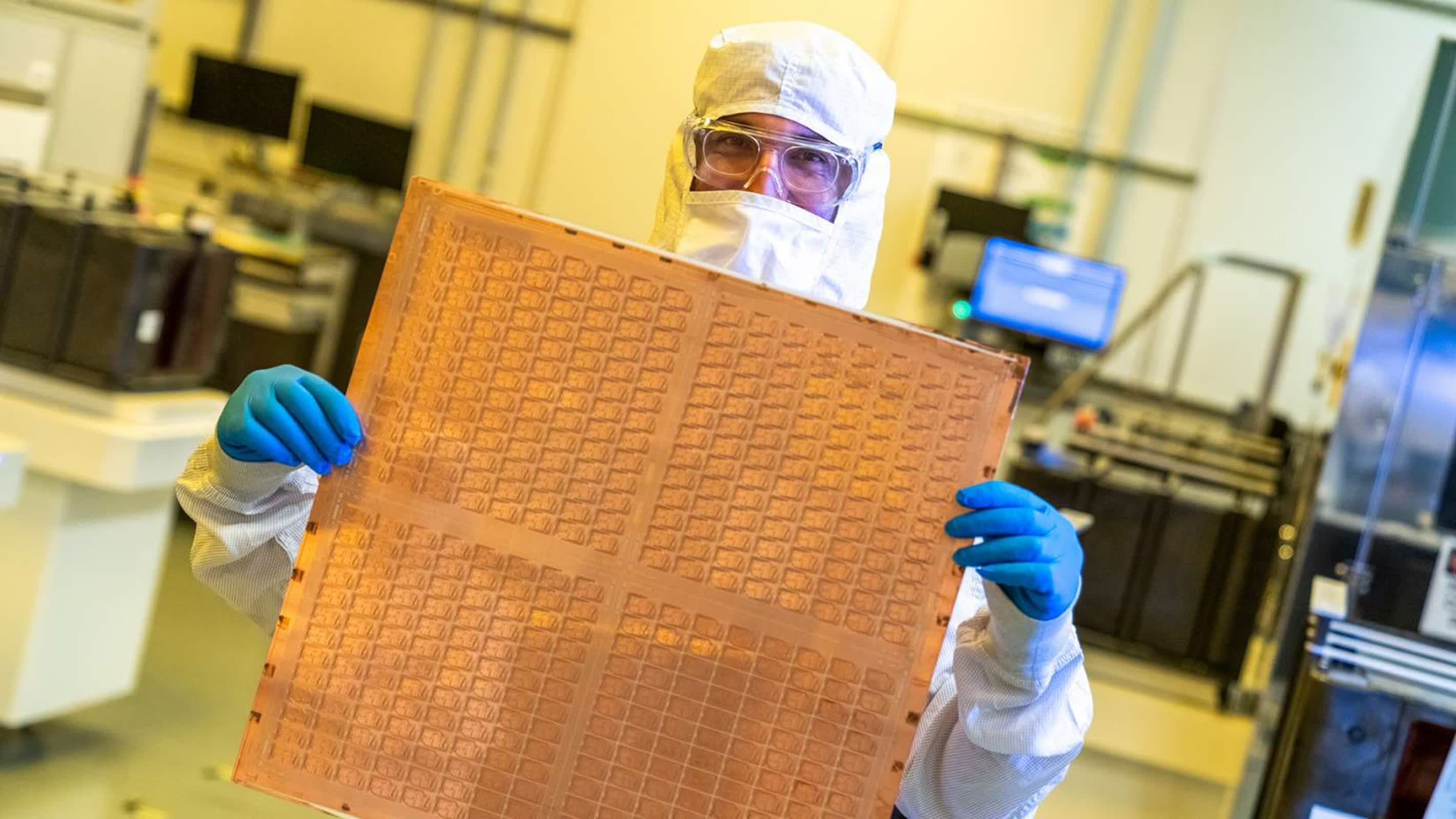

Samsung Electro-Mechanics is accelerating its efforts within the semiconductor glass substrate market by advancing its gear procurement and set up actions to September. Based on ETNews, it should additionally launch a pilot line for its next-gen packaging in Sejong, South Korea, within the fourth quarter – one quarter forward of schedule.

Earlier this 12 months, the subsidiary initiated R&D work on glass substrates and began exploring potential use instances.

Whereas Samsung hinted at the way forward for glass substrates throughout CES 2024, it now seems that the South Korean conglomerate is transferring ahead extra swiftly to achieve a aggressive edge, significantly towards Intel. Samsung now anticipates commencing manufacturing of glass substrates for high-end system-in-packages in 2026.

The corporate has finalized its checklist of suppliers for the tasks, deciding on Philoptics, Chemtronics, Joongwoo M-Tech, and Germany’s LPKF to supply parts.

Glass substrate holds appreciable promise for advancing the scaling of transistors in semiconductor packages. Intel forecasts that by the tip of the last decade, the semiconductor business will hit its limits in scaling transistors on silicon packages utilizing natural substrates because of their larger energy consumption, susceptibility to shrinkage, and warping.

In distinction, glass gives ultra-low flatness, enabling parts to be positioned nearer collectively, together with superior thermal and mechanical stability, resulting in considerably larger interconnect density in substrates, probably as much as a 10x enhance. These benefits empower chip architects to design high-density, high-performance chip packages fitted to data-intensive duties like synthetic intelligence.

Apple can also be exploring the potential of glass substrate and reportedly partaking in discussions with numerous suppliers, together with possible Samsung, to develop a method for integrating glass substrates into digital units.

Nevertheless, a number of challenges lie forward, together with the necessity to tackle integration and interface engineering points, as highlighted by Rahul Manepalli, fellow and director of substrate TD module engineering at Intel. Different obstacles embody fragility, insufficient adhesion to metallic wires, and difficulties in reaching uniform through fill, essential for constant electrical efficiency.

However, optimism prevails concerning resolving these challenges. The worldwide glass substrate market is projected to achieve $2.3 billion this 12 months and is predicted to witness a sturdy compound annual progress fee (CAGR) of 5.9 p.c from 2024 to 2034, with market income for glass substrate anticipated to achieve $4.2 billion by 2034.

![No beef with Pat McAfee regardless of stories [Update]](https://impulsoplus.com/wp-content/uploads/2024/05/157b62f1429f3465c2595a6f2ccef67e-75x75.png)