The bogus intelligence (AI) commerce took a flip for the more serious on Monday as Nvidia (NASDAQ: NVDA) shares dropped as a lot as 6.5%, dragging all the AI market with it.

Tremendous Micro Laptop (NASDAQ: SMCI) fell as a lot as 8.5%, and Taiwan Semiconductor Manufacturing (NYSE: TSM) was down 3.8% at its low at this time. The three AI shares have been down 4.9%, 7%, and three.2%, respectively, at 11:30 a.m. ET. There is no particular information about AI, however buyers have rather a lot on their minds concerning the future demand for the chips driving AI at this time.

Nvidia insiders are promoting in droves

On Friday, Nvidia insiders, together with CEO Jensen Huang, introduced huge inventory gross sales past simply tax gross sales associated to inventory choices and warrants. Huang reported he offered 240,000 shares on the open market on Thursday and Friday, totaling $31.6 million for simply these two days.

In June alone, Huang has already offered practically $95 million of inventory as he is been touting the expansion potential for AI long run. Quite a few different executives have additionally reported giant inventory gross sales on the open market.

Insider gross sales will be a sign they’re much less bullish on a inventory, which is why that is notable.

Is the bubble popping?

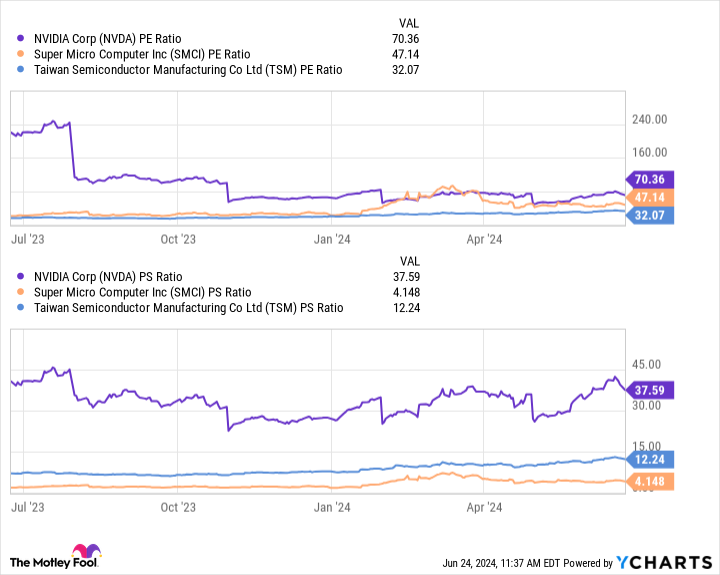

As spectacular as AI demand has been, the valuations of Nvidia and Tremendous Micro Laptop specifically have hit loopy ranges. You possibly can see beneath that Nvidia’s price-to-earnings (P/E) a number of continues to be over 70 and its price-to-sales (P/S) a number of is 37.6. Tremendous Micro Laptop is not fairly as costly, but it surely’s nonetheless priced for perfection.

Traders should contemplate how a lot progress is priced into AI shares proper now and what the chances are high that they are going to dwell as much as that potential. Only a few AI corporations earn cash, so the cash flowing to chips might decelerate if these which are creating AI fashions and instruments do not create enterprise plans that make them sustainable in the long run.

Earnings come into focus

Traders are immediately serious about demand as a result of we’re only some weeks away from the beginning of earnings season for the second quarter of 2024. That is after we’ll hear about finish demand and margins for tech corporations constructing AI merchandise, together with these shopping for probably the most Nvidia chips.

If demand is powerful, shares might go up, however buyers are taking cash off the desk for worry there could possibly be some disappointing indicators. And with shares priced to perfection, even the smallest crack within the AI progress story might ship them tumbling.

It is all as much as Nvidia

Nvidia is the most important identify in AI, and its fortunes will drive Tremendous Micro Laptop and TSMC, that are suppliers to the corporate and beneficiaries from the general progress in AI demand. If the marketplace for Nvidia chips continues to develop, the opposite corporations can have loads of demand.

What I believe the main focus over the subsequent month will likely be is the demand for AI merchandise that corporations have launched and whether or not or not that can result in extra capital spending. If not, there could possibly be a pullback in orders sooner or later, and that would put each income and margin projections into query.

These excessive valuations and lack of AI enterprise fashions are why I am avoiding AI shares at this time. The danger is just too excessive for the observable reward proper now.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Travis Hoium has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.

Nvidia Inventory Drops 6.5%, Dragging Synthetic Intelligence Shares Decrease was initially revealed by The Motley Idiot