Because the industrial revolution of the late 1700s, know-how has knowledgeable and led a sequence of radical adjustments in our societies and economies. The tempo has picked up velocity in latest a long time, because the world turned digital, and now AI is powering a so-called fourth industrial revolution, based mostly on a fast alternate of knowledge and knowledge.

In opposition to this backdrop, tech shares have led the way in which in market positive factors. The tech-heavy NASDAQ rose a formidable 43% final yr, and the S&P 500 rose 24%. Each indexes are persevering with to submit robust numbers this yr; for 2024 year-to-date, they’re up 24% and 17% respectively.

This has Wedbush analyst and tech knowledgeable Daniel Ives bullish on tech shares, noting: “The primary half of 2024 has been a really robust run for tech shares led by Massive Tech stalwarts Nvidia, Microsoft, Amazon, Meta as this 4th Industrial Revolution has simply begun to play out in our view on this 1995 Second (not 1999) with many bears nonetheless yelling from their hibernation caves… We consider NASDAQ has one other robust 2H forward as tech shares will likely be up 15% the remainder of 2024 in our view with tech fundamentals set to speed up as AI use circumstances materially develop.”

In opposition to this backdrop, we’ve opened the TipRanks database to search for two of Ives’ inventory picks – well-known tech giants – and see how his takes stack up in opposition to the Wall Avenue consensus. Listed below are the small print.

Microsoft (MSFT)

First on our listing, Microsoft has been main the sector in PCs and working programs because the Seventies, and has turn into one of many world’s most iconic model names. In recent times, the corporate, based mostly in Redmond, Washington, has continued its lengthy dedication to advancing know-how, by staking out a powerful place at the vanguard of the synthetic intelligence subject. Microsoft has a long-standing curiosity in AI, and was an early backer of OpenAI, the corporate that introduced us generative AI and Chat GPT on the finish of 2022. The corporate’s cumulative investments in OpenAI are within the neighborhood of $10 billion.

From the person perspective, Microsoft has a number of extremely seen AI initiatives. These embody the mixing of generative AI tech into the Bing search engine, in effort to make Bing extra person pleasant, with an improved interface and search outcomes, aiming at a stronger competitors with Google. Additionally, Microsoft is incorporating AI into the updates for the Home windows and Workplace software program packages. Outstanding amongst these additions to the long-lasting software program merchandise is the Copilot, Microsoft’s new AI-powered on-line assistant. The Copilot is designed to offer real-time person help, knowledgeable by the person’s personal work and content material creation histories.

Maybe the largest-scale use of AI in Microsoft’s product supply might be present in its cloud computing platform, the Azure subscription service. Azure is a package deal of cloud-based apps and instruments, greater than 200 all advised, and Microsoft is incorporating AI into the platform – prospects will be capable to select AI-enhanced variations of the Azure apps. The transfer guarantees to each make Azure a extra user-friendly product, with higher flexibility, and to make the platform a stronger competitor to Amazon’s AWS and to Google Cloud.

A take a look at Microsoft’s final monetary report, which lined fiscal 3Q24, exhibits that the AI improve to Azure is bearing fruit. Azure is a part of Microsoft’s Clever Cloud phase, which generated $26.7 billion in income for the quarter, up 21% year-over-year and 43% of the quarterly high line. The corporate’s complete income for fiscal Q3 was up 17% year-over-year, and reached $61.9 billion, beating the forecast by $1.01 billion. On the backside line, Microsoft noticed earnings of $2.94 per share, a determine that was 11 cents per share higher than had been anticipated – and was up 20% from the prior-year interval.

Shares in Microsoft have proven robust efficiency over the previous yr; unsurprising given the stable monetary outcomes. The inventory has gained 42% within the final 12 months, and is up virtually 25% to this point this yr.

For Ives, the important thing level right here is the potential of AI to unlock extra positive factors as MSFT goes ahead. He writes, “We consider the inventory nonetheless has but to cost in what we view as the following wave of cloud and AI progress coming to the Redmond story with a powerful aggressive cloud edge vs. Amazon particularly and Google in cloud bake offs. Our latest associate checks have been incrementally robust round Copilot deployments with MSFT prospects and in the end we estimate this might add one other ~$25 billion to Redmond’s topline trajectory by FY25. Right here is the important thing because the multiplier ripple impression from the Godfather of AI Jensen and Nvidia is simply beginning to be felt on the cloud/software program layer because the 2nd derivatives of the AI Revolution play out within the subject.”

The tech knowledgeable goes on to provide Microsoft shares an Outperform (Purchase) ranking, together with a value goal of $550, suggesting a one-year upside potential of 18%. (To look at Ives’ observe report, click on right here)

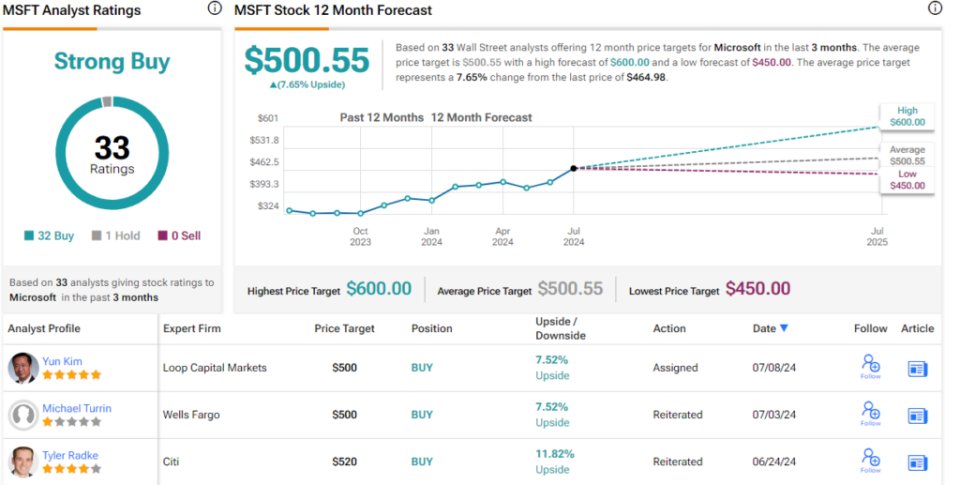

This venerable tech agency has picked up 33 latest analyst opinions, with a lopsided break up of 32 Buys to 1 Maintain giving the shares a Robust Purchase consensus ranking. The inventory is priced at $464.98, and its $500.55 common value goal implies it can achieve 7.5% within the coming yr. (See MSFT inventory forecast)

Salesforce.com (CRM)

Subsequent up is Salesforce, a well known title within the subject of buyer relationship administration, or CRM. Salesforce offers a superb definition of CRM, describing it as a system for managing firm interactions with all prospects, present and potential, with the easy aim of bettering relationships and increasing the enterprise.

Salesforce has been within the CRM enterprise since 1999, and has perfected the system. The corporate affords an industry-leading, cloud-based software program platform that streamlines CRM actions, together with gross sales calls, advertising and marketing emails, and customer support interactions. The platform tracks these interactions and builds up a unified database comprised of buyer and firm data.

In recent times, Salesforce has built-in AI know-how into its CRM software program merchandise, additional enhancing the talents of each builders and customers to customise the platform, becoming it to any scale or enterprise goal. The corporate’s AI integration streamlines information retrieval, improves communications, automates repetitive duties, and generates actionable insights via autonomous information evaluation. Salesforce can be making use of generative AI for automated artistic functions – producing customized buyer communications, together with concentrating on advertising and marketing contacts and figuring out the very best timing for his or her launch.

Salesforce has, in its years of operation, made itself a necessary a part of the enterprise universe, providing a mandatory service, based mostly on the most recent know-how, and delivering stable outcomes for its prospects.

As for Salesforce’s outcomes, the corporate reported its fiscal 1Q25 monetary launch on the finish of Might and beat the forecast on earnings whereas lacking on income. The corporate’s income got here to $9.13 billion, up virtually 11% from the prior yr however $20 million lower than had been anticipated. The underside line was reported as $2.44 by non-GAAP measures, for a 44% y/y enhance – and beating the estimates by 7 cents per share.

The corporate reported some extra metrics that ought to pique investor curiosity, together with $8.59 billion in subscription & assist income, up 12% year-over-year and a important driver of the general income progress. Free money circulate was up within the quarter, by 43% y/y, to achieve $6.08 billion. Salesforce completed the quarter with $9.96 billion in money and liquid property readily available, as of April 30 this yr.

Whereas these outcomes had been sound, shares in Salesforce dropped sharply after the discharge – primarily when the Q2 forecast didn’t impress. Firm estimates for each income and earnings in Q2 got here in beneath the consensus estimates. At the moment, the inventory is flat for the year-to-date.

Dan Ives, in his protection of Salesforce, takes an investor’s perspective – and he’s impressed by the corporate’s present capabilities and near-term potential. Ives writes of Salesforce, “In our view, CRM is on the trail to the next progress, margin, and FCF trajectory and that is only a small bump within the street throughout a transitionary progress interval… CRM [remains] one in all our favourite tech names to personal over the following yr because the AI story begins to take form. We’d be patrons on weak spot… as seeing the forest via the timber this can be a turnaround in movement for a premier tech stalwart with an enormous put in base led by among the finest CEOs within the world tech panorama in our view.”

Taking these feedback ahead, Ives charges CRM as Outperform (Purchase), with a $315 value goal that implies a 21% achieve within the months forward.

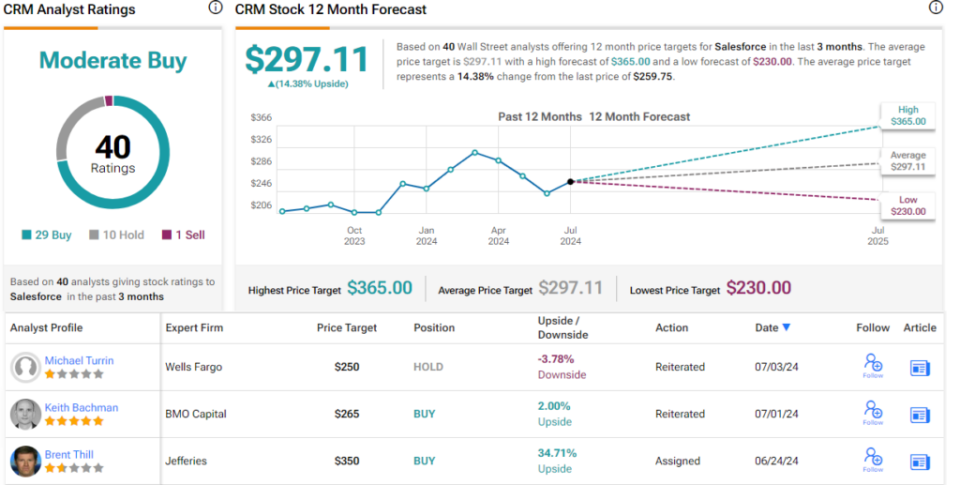

There are 40 latest analyst opinions on report for Salesforce shares and so they break all the way down to 29 Buys, 10 Holds, and 1 Promote, giving the inventory its Average Purchase consensus ranking. The shares are priced at $259.81, with a $297.11 common goal value that signifies potential for a 14% upside on the one-year horizon. (See CRM inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather essential to do your personal evaluation earlier than making any funding.