Riot Platforms (NASDAQ: RIOT) is without doubt one of the prime Bitcoin mining corporations you may put money into right now. 12 months to this point, nevertheless, the inventory has been struggling, and it is down 30%. However lately the corporate posted some spectacular earnings numbers, even turning a wholesome revenue. May Riot Platforms be an underrated inventory to purchase proper now?

The corporate posted file numbers in Q1

On Could 1, Riot Platforms launched its earnings outcomes for the primary three months of 2024. Through the interval, the corporate reported a revenue of $211.8 million, which was a brand new quarterly file for the enterprise. Its adjusted earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) of $245.7 million was one other file excessive.

The caveat, nevertheless, is that the outcomes have been largely as a consequence of adjustments in truthful worth. With Bitcoin mining corporations, positive factors and losses can play a major position in whether or not the enterprise turns a revenue or not. Final quarter, as an illustration, adjustments within the truthful worth of Bitcoin had a optimistic $234.1 million affect on Riot’s operations, which was far increased than all of its different bills. Bitcoin mining prices of $41.1 million rose by 88% 12 months over 12 months, and promoting, normal, and administrative prices totaling $57.7 million have been greater than 4 instances the $12.7 million Riot reported for that line merchandise a 12 months in the past.

Whereas it is true that Riot had a file efficiency in Q1, that is what you’d name low-quality earnings within the sense that they will not be sustainable or show to be constant. When positive factors and losses could be the distinction between a revenue and a loss on an organization’s financials, that introduces a variety of period-over-period volatility; the corporate’s working earnings this previous quarter was $203.9 million versus solely $17.4 million a 12 months in the past.

And simply because Bitcoin’s worth is rising doesn’t suggest Riot’s inventory will generate nice returns for buyers. Whereas which will have been the case up to now, it may very well be a special scenario shifting ahead.

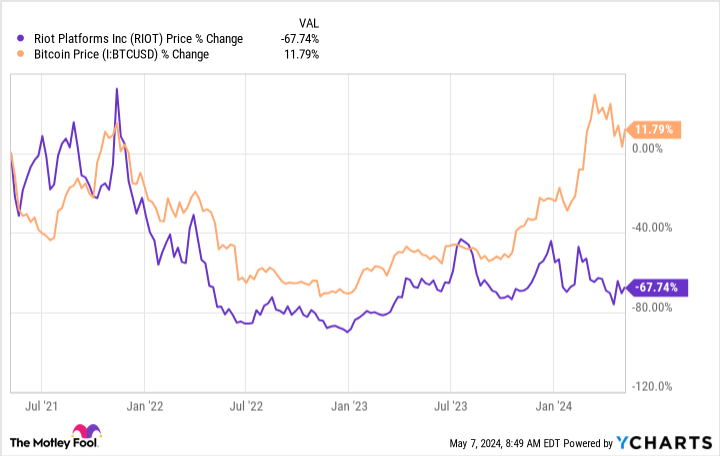

Riot’s inventory and Bitcoin have diverged of late

For the previous few years, Riot’s inventory adopted an identical path to Bitcoin. Mining corporations profit from rising crypto costs, and so it is unsurprising to see that because the digital forex rises in worth, so too does the worth of a prime mining firm corresponding to Riot. However lately, that has begun to vary.

The current Bitcoin halving occasion could also be answerable for this divergence, as buyers know that it’s going to take greater than only a excessive worth to assist Riot generate robust numbers sooner or later; the corporate may also have to turn out to be extra environment friendly now that mining rewards have been minimize in half.

Riot is scaling its enterprise

Riot has been investing in rising its hash fee, which may help it mine extra Bitcoin. On the corporate’s current earnings launch, administration acknowledged that by the top of the present 12 months, its self-mining hash fee capability ought to hit 31 exahashes per second — practically tripling its current hash fee capability. The corporate says its Corsicana facility “would be the largest devoted Bitcoin mining facility on this planet as soon as totally developed.”

The problem, nevertheless, is that these efforts inevitably result in extra prices for Riot because it spends cash on infrastructure and provides extra employees. The corporate wants to extend capability to have the ability to mine extra Bitcoin to assist offset the results of halving. However on the similar time, its day-to-day working bills will go up, which is able to make it tougher to remain within the black.

Is Riot Platforms a great inventory to purchase?

Riot Platforms’ current outcomes have been spectacular, however they merely will not be sustainable. That is why buyers ought to train a level of warning with the inventory, as future quarters might look a lot completely different, particularly as the corporate begins to really feel the results of halving and receiving much less Bitcoin for its mining efforts.

Though the crypto inventory might look low-cost proper now, buyers are higher off simply keeping track of Riot Platforms reasonably than investing in it; there’s nonetheless an excessive amount of threat within the enterprise for it to be something greater than a speculative inventory.

Must you make investments $1,000 in Riot Platforms proper now?

Before you purchase inventory in Riot Platforms, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Riot Platforms wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $550,688!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 6, 2024

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Bitcoin. The Motley Idiot has a disclosure coverage.

Is Riot Platforms Inventory a No-Brainer Purchase After Posting Document Numbers? was initially printed by The Motley Idiot