Why it issues: When the pandemic rolled by means of the worldwide economic system 4 years in the past, it grew to become clear to US officers that they’d let its home semiconductor manufacturing capabilities deteriorate to harmful ranges. Therefore the seeds of the CHIPS and Science Act have been planted. The Act was allotted a complete of $52.7 billion when it was signed into legislation in August 2022 and it has been doling out cash out ever since. The most recent recipient will doubtless be Texas Devices, which has plans to make use of the funding to reinforce its footprint in high-volume 300mm wafer capability.

In a transfer aimed toward bolstering the US’ semiconductor manufacturing capabilities, Texas Devices and the US Division of Commerce have signed a preliminary settlement outlining potential phrases for as much as $1.6 billion in proposed direct funding underneath the CHIPS and Science Act.

This funding would assist the development of three 300mm wafer fabrication services in Texas and Utah. Alongside this, TI anticipates receiving a further $6 billion to $8 billion from the US Division of Treasury’s Funding Tax Credit score, designed to incentivize certified US manufacturing investments. Collectively, these monetary boosts are set to assist TI safe a geopolitically secure provide of important analog and embedded processing semiconductors.

The proposed direct funding is part of TI’s formidable plan to take a position over $18 billion by means of 2029 to broaden its manufacturing footprint.

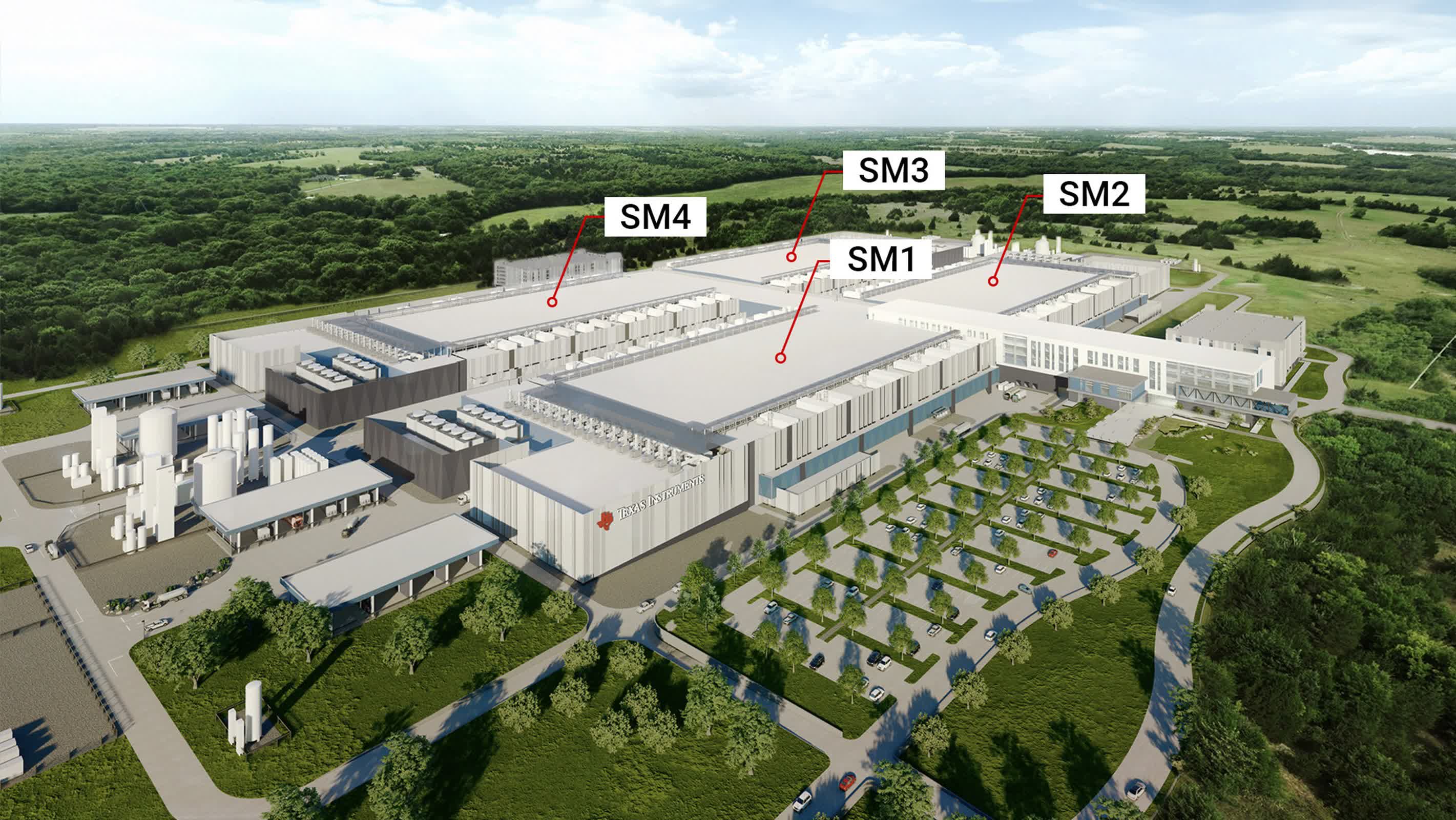

The CHIPS Act funding will probably be allotted to 3 new wafer fabs: two in Sherman, Texas, and one in Lehi, Utah. The Sherman services, SM1 and SM2, are poised to turn into main gamers within the semiconductor business, producing 65nm to 130nm chips with an anticipated each day output exceeding 100 million chips. Notably, the Sherman website stands out as one of many few greenfield manufacturing websites for 300mm wafer chips in the USA.

In the meantime, the Lehi, Utah facility, LFAB2, is about to supply 28nm to 65nm analog and embedded processing chips, with an anticipated each day manufacturing of tens of tens of millions of chips. This venture marks the biggest financial funding in Utah’s historical past.

TI is likely one of the few corporations within the US constructing high-volume 300mm wafer capability for foundational applied sciences. Its efforts are essential to rising home manufacturing capabilities for mature-node chips, that are important for a variety of functions, from client electronics to vital infrastructure.

The corporate’s funding aligns with broader nationwide efforts to revitalize the US semiconductor business, which has seen its share of world manufacturing decline from 37% to simply 12% over the previous three many years.

It took the COVID-19 pandemic to show the impression of this decline with its disruption of the worldwide semiconductor provide chain, which notably harm the US automotive, industrial, and protection sectors. These industries rely closely on semiconductors for his or her operations, and the disruptions brought on by the pandemic led to extreme manufacturing slowdowns and elevated prices.

For example, the US automotive business confronted manufacturing halts and furloughs on account of chip shortages, contributing to a pointy rise in automobile costs and impacting the general economic system. The scarcity was so extreme that it reportedly knocked a full share level off the US GDP in 2021.

By specializing in constructing strong home manufacturing capabilities, TI and different business leaders hope to construct a extra resilient and self-sufficient provide chain. This technique will assist keep away from future disruptions and assist the nation’s long-term financial development and technological progress.