Chrissy Arsenault and her husband, Ryan, did not develop up rich. To get forward financially, they’ve lengthy recognized {that a} mixture of “arduous work and frugality” can be mandatory, Arsenault informed Enterprise Insider through electronic mail.

So when the couple discovered concerning the FIRE motion of their mid-20s, it was music to their ears.

FIRE is an acronym for “monetary independence, retire early.” Usually, individuals who’ve embraced the FIRE motion wish to develop their financial savings to allow them to obtain monetary freedom and retire earlier than they flip 65 — although some folks favor to maintain working. To perform their targets, some FIRE advocates save most of their earnings, tackle facet hustles, or delay pricey life milestones like having children. Many FIRE advocates hint the motion’s philosophy to the 1992 best-selling ebook “Your Cash or Your Life.”

To be taught extra concerning the FIRE motion, particularly methods for maximizing financial savings and reaching monetary independence, the couple sought out FIRE-related YouTube movies, Fb teams, newsletters, and podcasts. They then tried to use a few of that info to their monetary methods.

Their efforts have paid off.

Over the previous a number of years, the couple has grown their mixed internet price to greater than $800,000, based on paperwork considered by BI. Arsenault stated their purpose is to develop their investments to roughly $2.5 million over the following 10 to fifteen years — which she hopes will enable them to retire earlier than she turns 50. Each she and Ryan are of their early 30s.

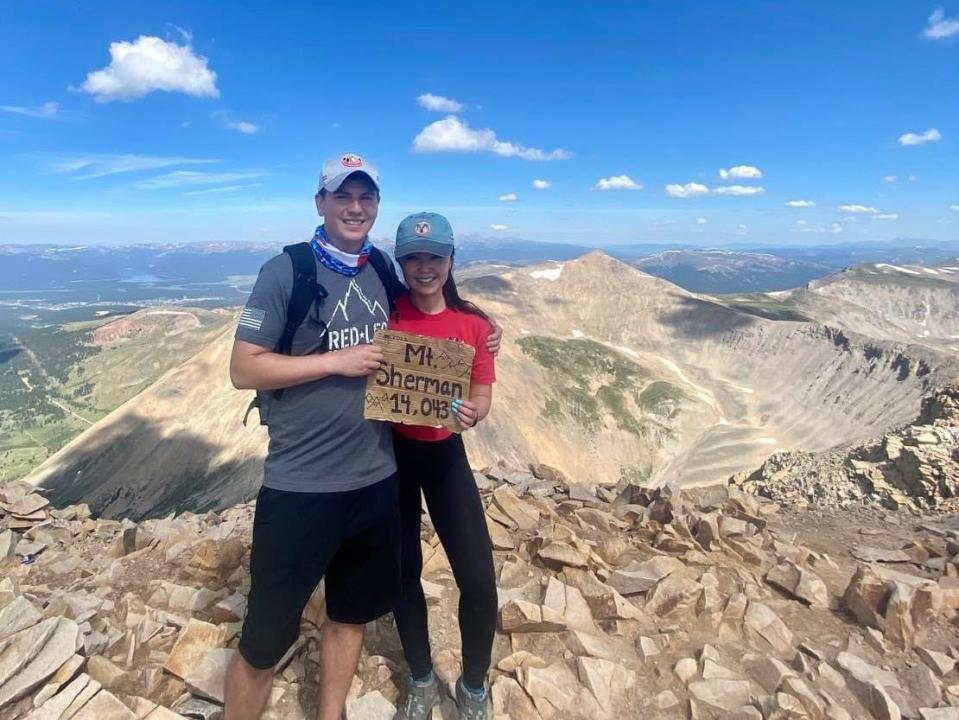

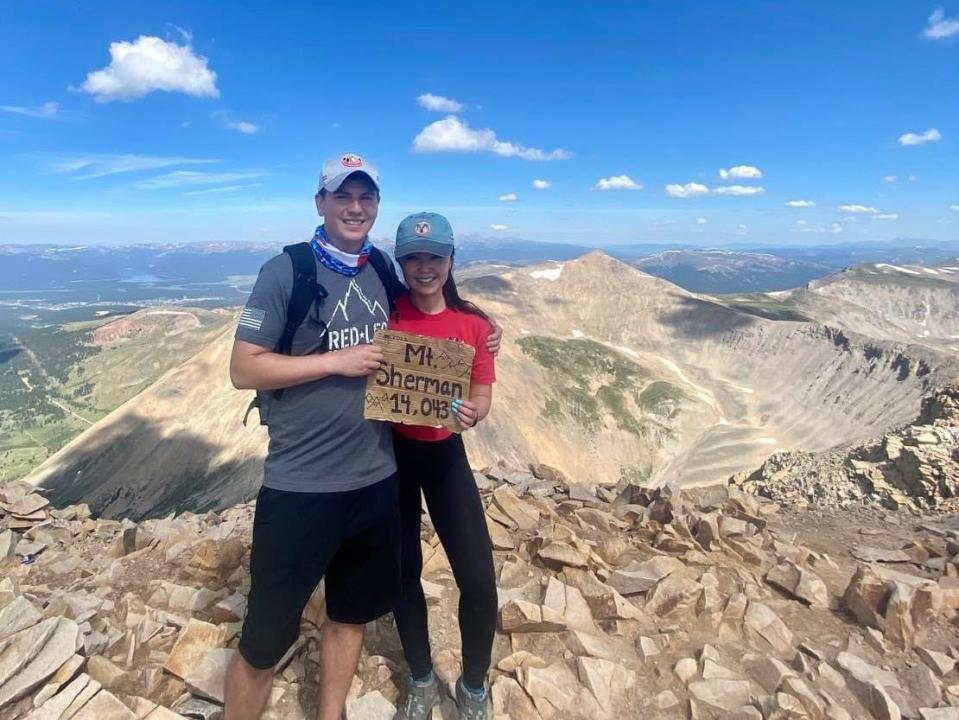

“Retiring at 65-plus years previous simply does not sound interesting,” stated Arsenault, who works as a advertising and marketing director and is predicated in Colorado. “I am certain we’ll nonetheless be lively and wholesome at that age, however there’s much more that we will get pleasure from after we’re in our 40s and 50s.”

As many Individuals battle to avoid wasting for retirement — and plenty of retirees really feel they do not have sufficient to cease working — the FIRE motion has supplied a potential blueprint for individuals who need monetary safety. Whereas some folks have discovered success with FIRE, it hasn’t been a good match for everybody, partly as a result of it might require vital financial savings targets that may not at all times be real looking. Nonetheless, FIRE proponents dwell a big selection of life. And consultants say some ideas of FIRE — like the advantages of saving and investing at a younger age to reap the benefits of compounded funding returns — are relevant to a large viewers.

Arsenault shared her and Ryan’s prime methods for rising their financial savings — and the one change to their life-style that might make an early retirement a bit harder.

Find out how to dwell a FIRE life-style

Arsenault summed up the couple’s monetary technique as “spend much less, make extra, and make investments extra.”

To spend much less, she stated they’ve diminished how a lot they dine out at eating places, purchased in bulk from Costco, deliberate their very own holidays fairly than utilizing journey brokers, prevented fitness center memberships by understanding at dwelling, and restricted alcohol consumption.

They’ve additionally postponed sure bills to avoid wasting further money.

“I went a few years with a damaged telephone display and actually did not thoughts,” she stated.

To earn more money, Arsenault stated they’ve “aggressively pushed for added earnings.” For Arsenault, this has taken on the type of “climbing the company ladder” — she stated she landed a six-figure wage at age 26. She additionally began a facet hustle working as a registered dietician, one thing she focuses on throughout evenings and weekends.

Ryan works full-time as a human sources skilled. In his spare time, Arsenault stated he focuses on managing the couple’s three funding properties which give them with passive earnings. The couple’s mixed taxable earnings was roughly $250,000 in 2023, based on a doc considered by BI.

When their methods generate extra cash, the couple invests as a lot as potential of their 401(ok) plans and low-cost index funds.

In case of emergencies, the couple retains about six months of funds in financial savings.

Arsenault stated saving cash was simpler when she and Ryan lived in Indiana. The couple relocated to Colorado throughout the pandemic, a couple of years into their FIRE financial savings journey.

One of many greatest variations between the 2 states has been the housing prices, Arsenault stated. The couple is predicated in Monument, Colorado, the place the typical dwelling worth is about $743,000, per Zillow. In Fishers, Indiana, the place they used to dwell, the typical dwelling worth is $426,000.

Within the years forward, one life-style change might put some extra strain on the couple’s funds: They’re anticipating their first youngster, which they know will include many new month-to-month bills.

Nonetheless, Arsenault stated she thinks her monetary targets are nonetheless achievable, partly as a result of she and Ryan have been planning for all times with a new child. They’ve even deliberate how you can finance their kid’s potential faculty schooling.

“We have began to avoid wasting up for his 529 plan in order that they will attend faculty,” she stated, referring to the funding account that gives tax-free withdrawals when the cash is used for sure schooling bills.

Are you a part of the FIRE motion or dwelling by a few of its ideas? Attain out to this reporter at jzinkula@businessinsider.com.

Learn the unique article on Enterprise Insider