Synthetic intelligence (AI) is a really revolutionary expertise that has captured the creativeness of buyers like few issues earlier than. This can be a double-edged sword, even when the tech actually is right here to remain. If we realized something from 2000, it is that an excessive amount of hype round new expertise with out the economics to again up sky-high valuations is harmful territory to be in.

I do not wish to draw too shut a parallel right here — there are many causes to imagine this isn’t dot-com bubble spherical two — however it’s all the time prudent to keep up a wholesome skepticism throughout a growth. All eyes — skeptics’ and believers’ alike — are on Nvidia‘s (NASDAQ: NVDA) upcoming annual shareholder assembly.

On June 26, 2024, the figurehead of the AI revolution will maintain the assembly, discussing technique and holding votes on motion objects like board approvals. Usually, annual common conferences do not transfer the needle as a lot as earnings reviews do, however it’s nonetheless an essential occasion that might assist make clear what the longer term holds for Nvidia and the market as an entire.

So, with the assembly quick approaching, is it a great time to hop on board the Nvidia practice? Listed below are three causes the inventory nonetheless seems sturdy.

1. Nvidia has plenty of money to play with

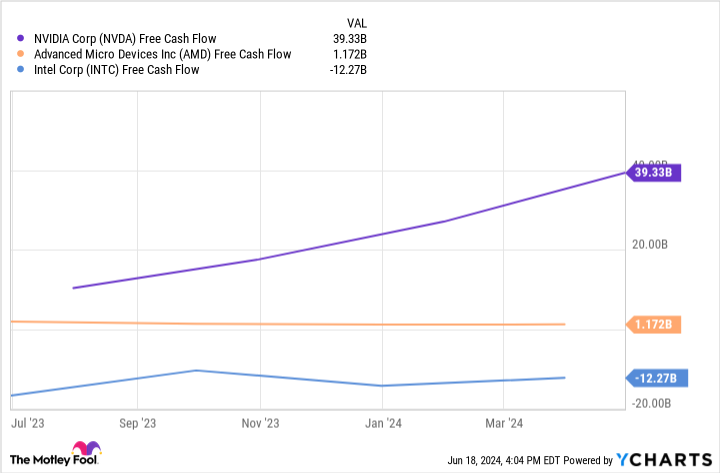

As the corporate has rocketed to stardom and confirmed how profitable the enterprise is, its competitors desires a chunk of that revenue. The specter of an AMD or Intel catching up and consuming into the roughly 80% market share Nvidia enjoys is actual and must be taken severely. Nevertheless, Nvidia has main sources to defend itself by means of fixed innovation.

In tech, having the very best product goes a great distance. AMD and Intel want to supply a product corresponding to Nvidia’s in the event that they hope to chip away at its market share. This takes cash — plenty of it. AMD spent $1.5 billion in analysis and improvement (R&D) final quarter, whereas Nvidia spent $2.7 billion. Bear in mind, Nvidia is already in pole place; it has the very best tech available on the market, and it is nonetheless outspending AMD nearly two to 1.

Intel, however, is outspending each, at $4.4 billion final quarter. The catch right here is that this spending is placing Intel within the purple. How lengthy can it stick with it?

Check out this chart exhibiting the free money circulation (FCF) of those corporations. FCF is an organization’s earnings after you’ve got subtracted working bills and capital expenditures (the cash an organization spends to develop) and it’s indicative of how a lot headroom an organization has if it desires to, say, improve R&D spending.

2. The market as an entire is rising quickly

So if we settle for that Nvidia has the sources to defend itself from its main opponents, we are able to assume Nvidia can preserve or develop its market share. There are definitely extra components, however it’s not an unreasonable assumption.

Statista.com predicts a compound annual progress price (CAGR) for the AI market at-large of about 28.5% by means of 2030. That may be a severely fast price of progress, albeit slower than the lightning pace at which the corporate has been rising just lately. Nonetheless, this could be an unbelievable progress price to keep up.

That is an estimate for the whole market — not simply semiconductors, that are Nvidia’s bread and butter — so this can be a very tough measuring stick. The semiconductor section may have a decrease CAGR price than this. Nevertheless, this brings me to my subsequent level.

3. Nvidia is not sitting on its laurels — it is increasing its income streams

There isn’t any doubt that what has led to Nvidia’s large success as of late is the sale of its highly effective AI-enabling chips, however the firm sees a future past this. Nvidia is making an attempt to construct a whole AI ecosystem. It’s partnering with corporations like Dell to supply full-scale, on-premises, AI computing options. It’s constructing applied sciences and end-to-end platforms designed for autonomous autos, humanoid robotics, and drug analysis. There’s extra, however I will cease right here. The purpose is that Nvidia intends to place itself on the very middle of all issues AI, as a star that different corporations orbit, somewhat than only one extra hyperlink within the chain.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Johnny Rice has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

3 Causes to Purchase Nvidia Inventory Earlier than June 26 was initially revealed by The Motley Idiot