Synthetic Intelligence (AI) shares have been battered over the summer time. The VanEck Semiconductor ETF, which is chock-full of semiconductor shares which are tied to the AI sector, fell as a lot as 25% from the all-time excessive it set in July.

However, I stay bullish on AI. Traders have solely seen the start levels of how this know-how will reshape the world, and extra improvements will take years and even a long time to emerge.

That could be a robust case for proudly owning AI shares long run — listed here are two I discover significantly compelling.

The cutting-edge chief in knowledge analytics

Topping my record is Palantir Applied sciences (NYSE: PLTR).

The corporate, which gives AI-powered huge knowledge options, is using excessive. Earlier this month, it was introduced that Palantir would be a part of the S&P 500 index. That information spurred a rally within the inventory, which has already climbed by 113% yr to this point.

Behind that wonderful efficiency is the corporate’s sterling fundamentals. Nonetheless a younger firm, Palantir is primarily centered on rising its buyer base and income. As of the second quarter, its quarterly income elevated to $678 million, up 27% from a yr earlier.

Equally, Palantir’s U.S. buyer depend is rising very quickly. The corporate reported 295 American business clients final quarter, up 83% yr over yr. Furthermore, Palantir is attracting bigger clients because it closed 27 offers price greater than $10 million every through the interval.

For sure, Palantir is using the wave of AI momentum. As CEO Alex Karp famous in his most up-to-date shareholder letter, “Our development throughout the business and authorities markets has been pushed by an unrelenting wave of demand from clients for synthetic intelligence programs that transcend the merely performative and tutorial.”

Briefly, the corporate has caught the wave and is using it properly. Traders searching for an AI inventory to purchase and maintain for the long run ought to strongly think about Palantir.

The inspiration of AI innovation

Subsequent on my record of AI shares is Nvidia (NASDAQ: NVDA).

That mentioned, Nvidia is a inventory I need to purchase and maintain for the following decade or longer. That is vital as a result of I’ve made no secret of my opinion that the inventory has turn into very costly.

Nonetheless, I nonetheless view it as a robust purchase as a result of AI is a long-term pattern that may play out over a few years. In the identical method the web continues to evolve, AI has an extended street forward of it.

That is nice information for Nvidia, particularly, as a result of its product is the go-to resolution in terms of constructing the “brains” of varied AI fashions. It makes the graphic processing models (GPUs) most favored by AI builders

The red-hot demand for AI-capable GPUs means Nvidia can cost prime greenback for its merchandise, together with the H100 and its soon-to-debut Blackwell chip.

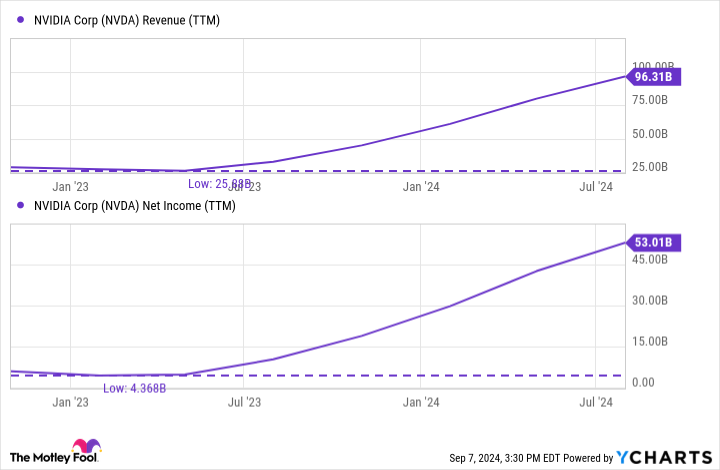

It is vital to recollect why Nvidia’s inventory has surged greater than 600% during the last two years: The corporate’s income and income are exploding.

In its most up-to-date quarter (ended July 28), income was $30.0 billion, up 122% from a yr earlier. During the last 12 months, the corporate has generated $96.3 billion in gross sales, up from $25.7 billion lower than two years in the past. Income have equally surged.

The corporate’s dominant place in AI has pushed its share value to new heights, however even following its unbelievable two years of beneficial properties, Nvidia stays an AI inventory I need to personal for the following decade and past.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Jake Lerch has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

2 Synthetic Intelligence (AI) Shares You Can Purchase and Maintain for the Subsequent Decade was initially printed by The Motley Idiot